Don't call it a trend or a fad. For Gen Z, secondhand shopping is a way of life

Younger consumers have turned to resale shopping with such intense commitment that their embrace of secondhand goods shouldn’t be described as a trend or a fad. It’s become a way of life for GenZers, and older customers are catching on.

In the US, the market for previously-owned clothing is expected to reach $74 billion by 2029, from total sales of about $49 billion in 2024, according to a new joint annual industry report from ThredUp, the world’s largest online thrift and consignment platform, and research and analytics firm GlobalData.

The secondhand clothing market worldwide is expected to hit $367 billion over the next four years, from an estimated $227 billion last year.

The momentum for resale shopping, which had started to pick up pace before the pandemic and then surged through it, remained robust last year, with 2024 logging 14% annual growth in the secondhand clothing market, the strongest annual growth since 2021, the report said.

“We’re continuing to see resale’s demonstrated staying power,” ThredUp’s CEO, James Reinhart, said in an interview with Bagable.com. “The number of young people shopping secondhand is hitting record highs.”

“I’ve been saying it for a long time that we’re really seeing this shift, generation by generation, around the acceptance and penetration of resale,” Reinhart said.

“For me as a GenXer, and those that are a little bit older, we had to be taught to shop secondhand,” he said. “We went to Goodwill to buy our Halloween costume and not because that's just what you wanted to do on a Saturday afternoon.”

For every successive generation of younger shoppers, resale shopping is becoming more and more native to their overall shopping experience and way of life, Reinhart said.

“There’s nothing that suggests to me in the data that these kids today are going to wake up ten years from now and say they’re only gonna buy new now. This shopping mindset is here to stay.” —James Reinhart, CEO of ThredUp

According to the report (which was based on a survey conducted in January and February of 3,034 adults older than 18 years of age), 58% of shoppers said they shopped for secondhand clothing in 2024. As many as 48% of younger shoppers said they looked at the secondhand market first when they needed to buy clothes.

The top five most-cited reasons in the report about why consumers are turning to resale purchases are that they offer better deals, shoppers enjoy the treasure hunt-like appeal of the experience, shoppers can find unique items, it’s better for the planet and it’s a more affordable way to score higher-end brands.

Gen Z’s growing preference for previously-owned, vintage and thrifted goods is so prevalent that it has practically become the norm for them.

“It does not even occur to my own Gen Z kid that maybe it hasn’t always been this way. For me, I would go to the mall and shop mall brands,” Reinhart said. “There’s nothing that suggests to me in the data that these kids today are going to wake up ten years from now and say they’re only gonna buy new now. This shopping mindset is here to stay.”

Most wanted brands at resale

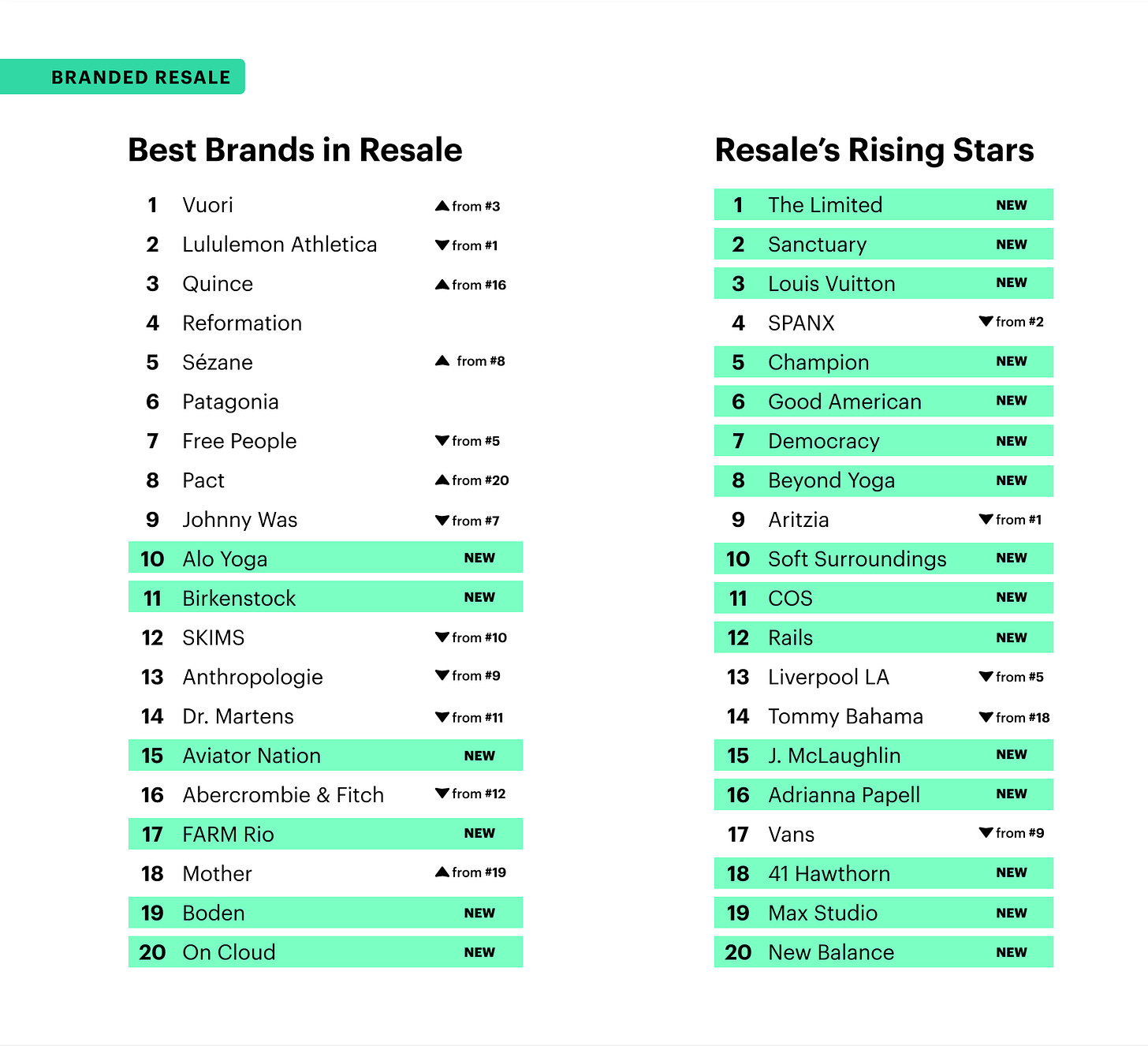

ThredUp, which handles more than 60,000 brands in its marketplace, surfaced the most in-demand labels and those that it called “resale’s rising stars.”

Its picks for the best brands at resale include Vuori, Quince, Sézane, Alo Yoga and Aviator Nation. The rising stars of resale include Good American, Sanctuary, The Limited, COS and New Balance.

An expanding group of mainstream fashion brands and retail chains, including H&M, Patagonia, PacSun, Madewell, Vera Bradley, Lululemon, Canada Goose, Levi’s and Nordstrom have introduced resale programs of their own or have partnered with secondhand platforms in recent years.

Reinhart said resale presents itself as a new revenue stream for brands that helps them stay competitive and acquire new customers.

At the same time, there are still some challenges that could prevent brands from fully diving into secondhand offerings.

“The trickiest part of all of this is going to be the profitability model of resale at the brand level,” he said. “The cost of cleaning and repair of previously-owned items and then stocking that inventory and then pricing it at a discount is something they have to manage. I think it’s ok if resale doesn’t become a huge part of a retailer’s overall businesses as long as they are doing the right thing by taking their products back and recycling.”

Looking at the current pressures on the consumer, including tariff concerns and their impact on store prices, Reinhart said the secondhand market isn’t immune to these headwinds.

The ThredUp report said more than half of the consumers surveyed would turn to more affordable products, such as secondhand offerings, if new government policies around tariffs and trade make clothing more expensive.

“It’s been a tough few years for retail between the pandemic, interest rates and inflation,” he said.

“With tariffs, the way that they've been currently identified, whether it's China, Mexico or Canada, and their impact on imported apparel, clothing prices in the US are going to increase,” Reinhart added. “The effect of that is resale will appear to be cheaper because I don't think we have the same exposure to tariff increases the way a traditional retailer does.”